Navigating the AI Tsunami in Retail

- Srikant Gokhale

- Jan 4

- 16 min read

Clarity Amid Chaos

--

“Artificial intelligence is the most consequential technological development in human history. The world has so far seen only the tip of the iceberg of its possibilities”- Mukesh Ambani, Chairman, Reliance Industries Ltd.

Retail leaders today are not short on ambition when it comes to artificial intelligence (AI). They are short on clarity.

Across boardrooms and executive committees, AI dominates agendas with a sense of inevitability and unease. Budgets are approved, pilots are launched, vendors are shortlisted—but confidence remains elusive. Many leaders privately admit that despite heavy investment, they struggle to explain where AI truly pays off, how it should be governed, or what it actually changes in stores, supply chains, and customer relationships. In PwC’s 27th Global CEO Survey, 76% of leaders acknowledge the need for reinvention, yet a majority remain uncertain about where to begin.

This is why AI feels less like a wave and more like a tsunami. It arrives everywhere at once, with enormous force, limited visibility, and little time to react. Unlike past retail transformations, the rise of e-commerce, omnichannel integration, or even automation—AI does not announce itself through a single channel or capability. It spreads horizontally across decisions, functions, and workflows. Forecasting, pricing, inventory, labor, marketing, customer service, and store execution are all affected simultaneously. The promise is leveraged everywhere. The reality is an uneven impact, fragmented ownership, and mounting pressure to act before a full understanding forms.

This article is based on my upcoming book, Navigating the AI Tsunami in Retail: Clarity Amid Chaos, to be published by Amazon Publishing. This work reflects two years of hands-on research into how AI is being adopted by retailers worldwide. It is grounded in 40 original case studies of top global retailers written by me, each based on a close examination and extensive research. The analysis also draws on reporting from top business and technology publications, insights from industry experts, and the perspectives of major consulting firms. Most importantly, it is informed by direct observation—time spent in stores and distribution centers, and conversations with retail leaders, professors, and teaching MBA/Executive MBAs participants in top schools—allowing me to assess whether AI-driven change is truly visible from the customer’s point of view, not just in strategy decks.

“AI is becoming transformative for our business, and we really haven’t had a technology revolution as large as this since the start of the internet.” — Doug Herrington, CEO, Worldwide Amazon Stores (NRF 2025)

The central argument is straightforward but uncomfortable: the confusion surrounding AI in retail is not a failure of leadership. It is a rational response to technology that behaves differently from anything the industry has encountered before. AI does not arrive as a program to be rolled out or a capability to be installed. It reshapes how decisions are made, who makes them, how often they are revisited, and how tightly execution is enforced. Traditional retail change playbooks—such as optimizing a function, launching a channel, or deploying a system—were never designed for this kind of shift.

The retailers that will emerge stronger from this moment will not be those that adopt the most tools or automate the most tasks. They will be the ones who impose discipline on where intelligence belongs, redesign the few decisions that matter most, and embed AI into execution rather than experimentation. The AI tsunami is real. But clarity—not urgency—is what will separate winners from the rest.

Why AI Feels Different in Retail

“It’s very clear that AI is going to change literally every job.”— Doug McMillon, CEO, Walmart on the wide-reaching workforce impact of AI across roles in retail

Retail has navigated disruption before. Big-box expansion rewired scale economics. Global sourcing reshaped cost structures. E-commerce introduced new channels. Omnichannel blurred physical and digital boundaries. Each shift was difficult, but legible. Leaders could point to a primary driver—a channel, a consumer behavior, a supply chain lever—and organize the business around it.

Artificial intelligence does not behave that way.

AI does not arrive as a single transformation. It embeds itself simultaneously into demand forecasting, inventory placement, pricing, store execution, customer service, marketing, labor planning, and logistics. It touches nearly every decision that governs retail performance, often without changing the visible surface of the business. As a result, leaders feel compelled to act but struggle to define what, exactly, they are acting toward.

This tension creates what many executives now experience as an AI paradox: the technology feels inevitable, urgent, and unresolved at the same time. AI appears powerful enough to matter, broad enough to affect everything, and ambiguous enough to resist clear ownership. Unlike prior transformations, there is no obvious starting point, no single finish line, and no established playbook to follow.

That paradox explains why investment has surged ahead of understanding. Across the industry, capital is flowing into AI platforms, pilots, and partnerships at unprecedented speed—not because leaders have clear roadmaps, but because the cost of standing still feels higher than the cost of uncertainty. Competitive pressure, board expectations, and fear of missing the next inflection point have accelerated spending even as confidence remains fragile.

The symptoms are now familiar. Pilots proliferate without scaling. Dashboards multiply without changing behavior. AI initiatives linger in limbo—neither expanded nor formally abandoned. Many leaders quietly admit that despite increased investment, they feel more exposed, not more in control.

As AI reshapes industries, many fear disruption. AI is an accelerator, not a threat."- Anand Mahindra, Chairman Mahindra Group

The root cause is not technological immaturity. It is a misaligned expectation.

AI is often discussed as intelligence, autonomy, or even decision-making. In practice, most retail AI excels at something far more specific: prediction, pattern recognition, and coordination under defined constraints. It reduces uncertainty in repetitive, high-volume decisions. It does not define strategy, resolve trade-offs, or substitute for leadership judgment.

Until this distinction is made explicit, AI will continue to frustrate. Retailers will expect transformation where AI can only deliver improvement, and autonomy where it can only offer support. Resetting expectations is therefore not a technical exercise—it is a leadership requirement. Without it, AI will remain everywhere in the organization, yet fully owned nowhere.

Where AI Actually Creates Value

Across formats and geographies, AI’s economic impact in retail concentrates in a surprisingly small set of decisions. Demand forecasting. Inventory placement. Pricing and promotions. Store and supply chain execution. These decisions are repeated thousands of times a day, are highly sensitive to error, and sit at the heart of retail economics. When they improve even slightly, the effects compound—quietly but powerfully.

This concentration of value explains why AI succeeds unevenly. Retailers that deploy AI broadly but shallowly—scattering use cases across functions without changing how decisions are made—often see little return. Dashboards improve. Pilots look promising. But outcomes remain stubbornly flat. By contrast, retailers that embed AI deeply into a few critical decision loops see consistent, measurable gains. The difference is not ambition; it is focus.

Amazon provides the clearest illustration—not because its model is easily replicable, but because it is internally coherent. At Amazon, AI is not an overlay on the business; it is the operating system. Demand forecasts inform where inventory is positioned. Inventory placement shapes fulfillment routes and delivery promises. Pricing adjusts dynamically within defined constraints. Each decision feeds the next through continuous feedback loops. Generative AI increasingly acts as an interface to this system—helping customers and employees navigate it—rather than replacing the underlying logic. Humans define boundaries and manage exceptions; machines manage flow.

Most traditional retailers operate at a different scale and with different constraints, but the lesson still applies. AI creates value when it reduces variability, tightens feedback loops, and enforces consistency between planning and execution. It fails when it is treated as a layer of insight disconnected from action. In those cases, AI becomes innovation theater—visible, impressive, and economically irrelevant.

The implication for leaders is straightforward but uncomfortable. AI does not reward breadth. It rewards discipline. The retailers that win are not those that ask, “Where can we use AI?” but those that ask, “Which decisions most determine our performance—and how should intelligence reshape them?”

The Quiet First Movers

“The speed and accuracy of [AI tools] give Pros more time to focus on what matters most: serving their customers and growing their businesses.”— Mike Rowe, Executive VP, Home Depot

What distinguishes retailers that have successfully scaled AI is not bold experimentation or technological bravado. It is restraint. The quiet first movers did not chase every breakthrough or attempt to reinvent retail overnight. Instead, they focused on using AI to make their existing operating models work better—more consistently, more predictably, and with less friction.

Walmart exemplifies this discipline at scale. Rather than positioning AI as a replacement for human decision-making, Walmart has embedded it deeply into forecasting, replenishment, and store execution to reinforce operational rigor. AI systems prioritize tasks for associates, flag inventory discrepancies, and surface issues earlier in the day, reducing variability across thousands of stores. Human judgment has not been eliminated; it has been elevated. Managers focus on exceptions rather than routine flow, intervening where context matters most. The result is not a radically new store experience, but something far more valuable: reliability, day after day, at massive scale.

Home Depot offers a different but equally instructive lesson. In home improvement, demand is project-based, customer needs are complex, and variability is the norm. Attempting full automation in this environment would undermine trust rather than create efficiency. Instead, Home Depot has used AI to support associates by accelerating access to information, improving product availability, and simplifying execution. Associates are better equipped to guide customers through trade-offs, sequencing decisions, and problem-solving. AI handles preparation and precision; humans handle judgment and reassurance. The technology succeeds precisely because it respects the complexity of the category.

The same logic appears across very different retail formats. Tesco applies AI to improve demand forecasting and reduce waste in grocery, where small forecasting errors quickly erode margins. Zara uses analytics and machine learning to shorten feedback loops between stores and production, enabling speed without excess inventory. IKEA applies AI selectively to coordinate assortments, logistics, and availability across a global footprint. In each case, the pattern is consistent: intelligence is applied where it reduces friction and variability, not where it creates novelty.

Just as important as what these retailers automate is what they deliberately avoid. None attempts to hand strategic judgment to algorithms. None treats AI as an autonomous decision-maker across the business. And none allows technology teams to operate in isolation from core operations. This restraint is what makes their models theoretically replicable—and practically difficult. It requires leaders willing to say no as often as yes, to prioritize discipline over excitement, and to embed intelligence quietly into the fabric of execution.

The lesson of the quiet first movers is not that AI must be revolutionary to matter. It is that AI creates its greatest value when it strengthens the fundamentals retail has always depended on: availability, accuracy, speed, and trust.

Generative AI and the Execution Gap

“AI will completely revolutionise how customers interact with retailers.”— Ken Murphy, CEO, Tesco on expanding AI’s role in personalization and customer engagement while enhancing loyalty

Generative AI has intensified confusion in retail not because it lacks value, but because its value is highly visible. Chatbots, shopping assistants, and content tools create immediate, tangible experiences that are easy to demonstrate and easy to approve. For many retailers, this visibility has made generative AI feel like the center of the AI story—when in reality, it represents only one layer of it.

Source: McKinsey.com

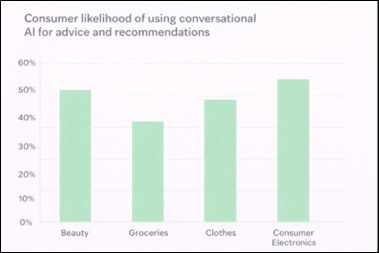

Some of the clearest early gains from generative AI have appeared at the customer interface. Instacart enables shoppers to move from intent to order with a single prompt, collapsing meal planning, list creation, and checkout into one interaction. Walmart translates event-based needs—such as hosting a party—into coordinated baskets without requiring customers to search item by item. Albert Heijn allows shoppers to upload a photo of a recipe and instantly convert inspiration into a tailored shopping list. In each case, generative AI reduces cognitive load and shortens the path from idea to action.

These applications matter. They improve convenience, engagement, and conversion. They make shopping feel easier and more intuitive. But they do not, by themselves, change the underlying economics of retail. Inventory productivity, margin structure, availability, and execution reliability remain governed by forecasting accuracy, replenishment discipline, data integration, and operational consistency—domains where traditional machine learning and decision automation still do the heavy lifting.

This gap between visible interface innovation and harder-to-see operational impact explains why many generative AI initiatives feel promising yet unsatisfying. Retailers see customer-facing improvements but struggle to trace those gains to sustained financial outcomes. When generative AI is expected to deliver structural performance improvements on its own, disappointment follows.

The retailers that gain leverage are those that separate roles clearly. They use generative AI to simplify discovery, guide intent, and reduce friction at the front end—while relying on core AI systems to improve forecasting, inventory flow, pricing discipline, and execution behind the scenes. In these organizations, generative AI is not treated as a business model, but as an interface layer built on top of a disciplined operating core.

As AI-driven discovery becomes a primary entry point into retail, this distinction will become more important, not less. The winners will not be those with the most impressive demos, but those who close

Agentic AI at the Customer Interface

“AI will completely revolutionise how customers interact with retailers.”— Ken Murphy, CEO, Tesco

Early examples of agentic AI are beginning to surface at the customer interface, where speed, coordination, and follow-through matter more than explanation. Unlike generative AI, which assists and recommends, agentic systems are designed to act. They move beyond suggestion to execution—collapsing discovery, evaluation, and transaction into a single, continuous flow. This shift is subtle but significant: AI is no longer just shaping decisions; it is carrying them out within defined boundaries.

Amazon’s beta testing of Buy for Me illustrates this transition clearly. When customers search for branded products, the system may surface relevant items sold outside Amazon’s own marketplace. With customer authorization, Amazon’s agentic AI completes the purchase end to end—handling checkout, payment, and delivery—without requiring the customer to leave the Amazon environment. The innovation is not expanded assortment, but delegated action. The AI is no longer helping customers shop; it is shopping on their behalf, governed by rules the retailer defines.

eBay is moving in a similar direction. Its agentic shopping assistant delivers real-time, highly personalized recommendations that respond to customer behavior as it unfolds, rather than waiting for explicit queries. Through its collaboration with OpenAI’s Operator research preview, eBay is experimenting with agents that actively guide discovery—steering customers toward relevant, often unique inventory instead of passively responding to search terms. Discovery becomes directional, not reactive.

In both cases, the value of agentic AI lies less in intelligence than in effort reduction. Customers make fewer decisions, encounter fewer handoffs, and complete tasks faster. The experience feels simpler not because it is more sophisticated, but because friction has been removed. As with earlier AI applications in retail, the lesson is consistent: advantage does not come from adding features, but from compressing workflows. Agentic AI matters because it shortens the distance between intent and outcome—and in retail, that distance often determines conversion, loyalty, and trust.

How AI Actually Scales

“When deploying AI, whether you focus on top-line growth or bottom-line profitability, start with the customer and work backward.”— Rob Garf, VP & GM, Salesforce Retail

Retailers that successfully scale AI do not begin with superior algorithms or more ambitious technology roadmaps. They begin with a fundamentally different view of how work should be done. Where stalled organizations treat AI as a project to be managed, scaling organizations treat it as an operating capability—one that reshapes decisions, accountability, and daily execution.

The first difference appears in data foundations. Retailers that scale AI invest early in creating shared, trusted data across merchandising, supply chain, stores, and digital channels. They recognize that inconsistent data erodes trust faster than imperfect models ever will. Forecasts, inventory positions, and performance metrics draw from common definitions, reducing debates over whose numbers are correct and shifting attention toward action. This work is rarely glamorous, but without it, AI remains peripheral—technically impressive and operationally ignored.

The second difference is clarity around decision rights. Scaling retailers are explicit about where AI recommendations are the default and where human judgment should intervene. They do not pretend that AI will be followed automatically, nor do they leave adoption to discretion. Instead, they define boundaries: which decisions machines make routinely, when overrides are appropriate, and how those overrides are reviewed. This transparency accelerates learning and builds trust. When overrides are measured rather than hidden, systems improve—and confidence follows.

Third, AI scales only when it lives inside workflows rather than on dashboards. Retailers that succeed embed intelligence directly into ordering systems, replenishment engines, pricing tools, task management platforms, and associate interfaces. AI does not generate insights to be reviewed later; it triggers actions in real time within defined constraints. This design choice matters. The less effort required to act on AI outputs, the more consistently those outputs shape outcomes.

Equally important is how leaders approach adoption. Accuracy alone does not drive impact—usefulness does. Retailers that scale AI invest heavily in training, communication, and iteration. They design tools that reduce cognitive load rather than add complexity, and they involve frontline users early in shaping how systems work. When AI helps employees succeed—by saving time, reducing frustration, or improving results—it spreads organically. When it feels imposed or opaque, it stalls quietly.

Organizational structure reinforces these choices. In scaling organizations, AI capabilities are embedded within business units rather than isolated in innovation labs or centralized analytics teams. Data scientists, engineers, and product managers work alongside merchants, operators, and store leaders, sharing accountability for outcomes. This proximity shortens feedback loops and ensures that intelligence informs decisions that actually matter.

Finally, leaders who scale AI are disciplined about measurement. They evaluate AI initiatives using the same metrics that govern the rest of the business: availability, inventory turns, waste reduction, conversion, margin, and execution reliability. Technical indicators belong in engineering reviews, not executive dashboards. Projects that fail to move core outcomes are revised or shut down, regardless of how sophisticated the technology appears. Over time, this discipline turns AI from an experiment into an expectation.

None of these practices is revolutionary. All are well within reach of most retailers. What distinguishes the leaders is not ambition, but persistence. They make a small number of structural choices early—and then enforce them relentlessly. As AI becomes embedded into forecasting, inventory placement, pricing, and execution, variability declines. Decisions become more consistent. Operations become more reliable. These gains are incremental, but they compound.

This is how AI actually scales in retail: not through breakthrough moments, but through disciplined redesign of how decisions are made, executed, and learned from. Technology enables progress, but leadership sustains it.

Automation or Augmentation? The Future of Retail Is More Human Than It Looks

“Rather than thinking about it solely as a job replacement tool, how do you think about reducing someone’s workload by 50%?”— Marvin Ellison, CEO, Lowe’s on using AI to improve productivity

Few questions generate more anxiety in retail than whether artificial intelligence will ultimately replace people. Headlines about robots, cashierless stores, and autonomous systems reinforce the fear that automation is an end state rather than a tool. Yet the evidence emerging from retailers that are actually deploying AI at scale points to a very different outcome—one that is less about replacement and more about redesign.

Automation in retail advances unevenly, and for good reason. It accelerates where work is repetitive, rules-based, and predictable. Logistics, fulfillment centers, and back-office processes are natural candidates. Here, AI and robotics reduce physical strain, increase throughput, and improve reliability. These gains are real, measurable, and economically compelling. But they do not eliminate the need for people. They change where people add value.

In stores, the dynamic is fundamentally different. Customer interactions are variable, situational, and emotionally loaded. Needs change mid-conversation. Exceptions are constant. Trust matters. In these environments, AI succeeds not by replacing associates, but by augmenting them—improving execution, surfacing relevant information faster, and reducing the cognitive burden of routine tasks. Associates spend less time searching for problems and more time solving them. Their role shifts from task execution to judgment, guidance, and service.

The post-COVID evolution of physical retail reinforces this pattern. During the pandemic, many predicted the permanent decline of stores. Instead, stores reasserted their relevance—as fulfillment hubs, service centers, and places where customers sought reassurance and expertise. Technology did not make stores obsolete; it changed how they created value. AI is following the same trajectory. By making execution more reliable—fewer stockouts, better availability, clearer priorities—it raises the importance of the human moments that customers actually remember.

This is the paradox leaders must internalize: as machines handle more routine execution, the premium on human capability increases. Differentiation shifts away from speed alone and toward competence, connection, and trust. Retail becomes less about transactions and more about confidence. Associates are no longer measured primarily by how many tasks they complete, but by how effectively they resolve ambiguity and build relationships.

The future of retail is therefore not fully automated, nor nostalgically human. It is intentionally hybrid by design. Machines manage repetition and scale. AI supports decisions and prioritization. Humans handle complexity, empathy, and accountability. Retailers that design their operating models around this division of labor do not shrink the human role—they elevate it.

Conclusion: From Experimentation to Advantage

“We happen to believe that virtually every customer experience will be reinvented using AI.”— Andy Jassy, CEO, Amazon

After years of pilots and proofs of concept, the remaining question in retail is no longer whether AI works. The evidence is now clear. AI improves forecasting accuracy, reduces waste, tightens execution, and simplifies customer journeys. The real question is whether organizations are prepared to use AI consistently, at scale, and with discipline.

This is where many retailers falter.

AI’s return on investment is real, but it is rarely obvious in the short term. Unlike store openings, acquisitions, or pricing resets, AI does not announce itself through dramatic step changes in revenue. Its impact accumulates quietly through cost avoidance, productivity gains, and risk reduction. Slightly better forecasts reduce waste. Slightly fewer stockouts protect margin. Slightly faster responses to disruption prevent losses that never appear on a report. Each gain is modest in isolation. Together, they compound.

That compounding effect is what accelerates a winner-takes-more dynamic in retail. Retailers that embed AI into core decisions—forecasting, inventory placement, execution, and pricing—learn faster than competitors. Table A below highlights the key retail metrics that indicate whether AI is creating true operating leverage. Their systems improve with every cycle. Their variability declines. Their execution becomes more reliable. Over time, these advantages reinforce one another, widening the gap between leaders and laggards. Late adopters do not just start behind technologically; they start behind experientially, lacking the decision history and feedback loops that allow AI systems to improve.

This is how AI quietly creates competitive moats. Not by replacing people or automating strategy, but by making everyday decisions more consistent and harder to out-execute. In a low-margin industry, that consistency matters enormously. As AI-driven advantages accumulate, scale increasingly begets more scale—better availability drives loyalty, which in turn improves data, which sharpens models, and sharper models further improve execution. The separation is gradual, but it is relentless.

The leadership agenda over the next 12–24 months is therefore unmistakable. Retailers must move from pilots to defaults, from dashboards to workflows, from experimentation to accountability, from hype to capability, and from fear to intentional design. AI must be governed like an operating discipline, not funded like an innovation side bet.

The retailers that win in the next era will not be the most automated, the most vocal, or the most technologically flamboyant. They will be the most deliberate—those who redesign decisions, align accountability, and apply intelligence precisely where it creates operating leverage. In an industry already trending toward winner-takes-all outcomes, AI will accelerate the divide.

AI will not decide the future of retail. Leadership will.

References:

The AI-First Retailer, Sebastian Bak, Roelant Kalthof, and Becca Schwartz, bcg.com, November 2025

LLM to ROI: How to scale gen AI in retail, Mckinsey.com, August 2024

AI Is No Longer an Option—It’s the Future of Retail. Mike Edmonds, Pwc.com, March 2025

How AI is fundamentally reshaping the retail industry in 2025, Scott Lundstrom, August 2025

Why Generative AI-Powered Stores Are The Future Of Retail, Jens Torchalla, Tanja Colanero, and Corey Rochkin, oliverwyman.com,

AI in Retail, ibm.com

Artificial Intelligence (AI) in Retail, intel.com

Artificial intelligence (AI) in retail: a comprehensive guide, Patricia Staino, salesforce.com

The Business of Automation and AI-Powered Retail Predictions, Mark Fairlie, business.com, December 2025

How AI can benefit the retail industry, Catherine Dee, algolia.com, June 2024

How AI Is Revolutionizing Retail: Exclusive Insights From An Industry Expert, Pete Wilkins, forbes.com, June 2024

A look at retail’s year of AI news, Dani James. Retaildive.com, December 2025

2025: The year Agentic AI broke in retail, Dan Berthiaume, chainstoreage.com, December 2025

AI agents for shoppers: Rise of agentic AI in retail experiences, Capgemini.com

The case for agentic AI in retail with AI-sourcing, Saurabh Vijayvergia, Brian McCarthy, Deloitte.com, October 2025

Retail reinvented: Unleashing the power of generative AI, Accenture.com, June 2024

The state of AI in 2025: Agents, innovation, and transformation, McKinsey.com, November 2025

What does Agentic means, Brianna Blacet, moveworks.com, December 2025

Seizing the agentic AI advantage, Mckinsey.com, June 2025

Trust us to get your leaders to be at their best!

Comments